Probe CX is a tech-powered, global customer experience organization that amplifies human capabilities with technological excellence.

As an industry-leading CX and digital transformation provider, Probe CX has a resume to match any of our competition.

Industry-recognized certifications to protect what matters most to our clients and their customers.

Over 19,000 team members delivering exceptional customer experiences across four countries.

We help our clients become modern digital organizations by combining the latest technology with people, process and data.

Meet the team with unmatched experience committed to helping organizations create environments for digitally-enabled CX to thrive.

Discover how an offshore-onshore hybrid collections model achieved 41% monthly savings and increased digital payments by 87%.

A leading energy and gas industry retailer required support with credit collection activities and help to manage debt or financial hardship.

In this case study learn:

Download now for these insights and more.

One of Australia’s largest retailers in the energy and gas industry.

The client required a partner to support with credit collection activities and help manage debtor financial hardship, including back-of-house processing. Compliance with regulatory requirements was essential in choosing the right partner.

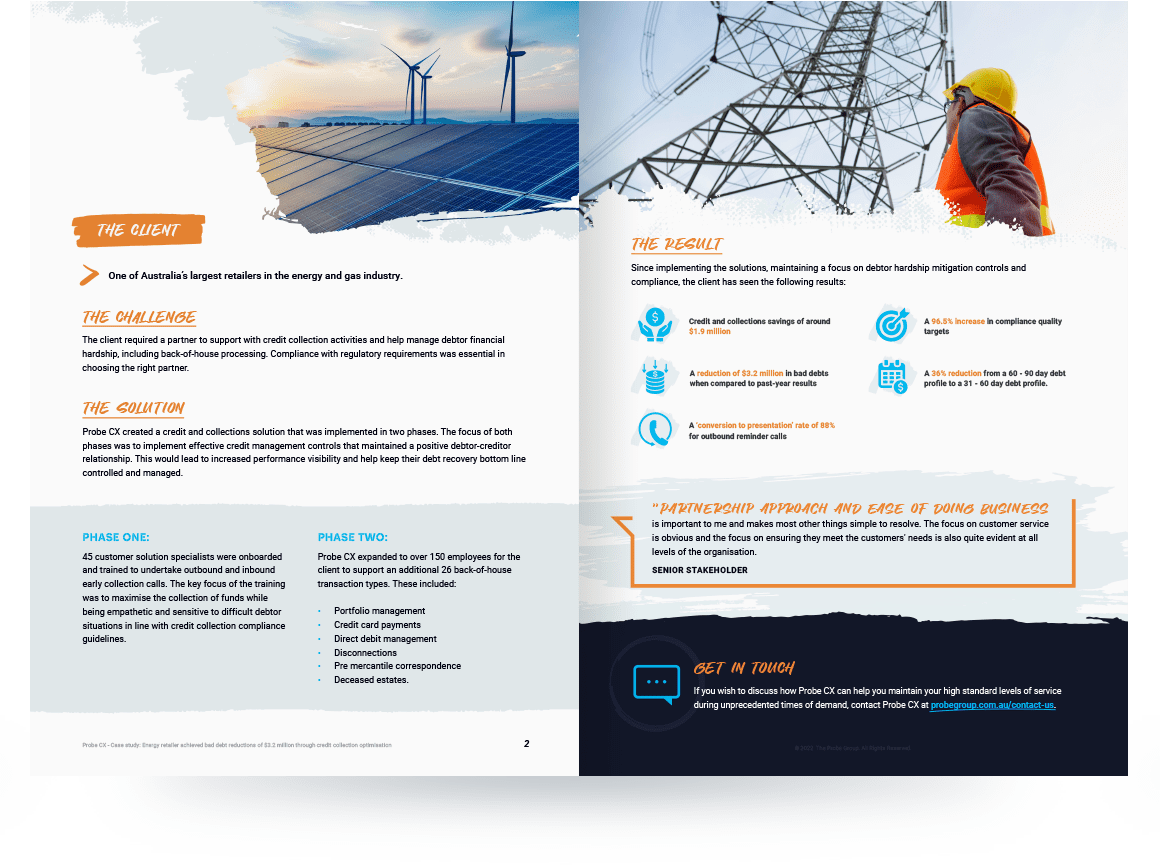

Probe CX created a credit and collections solution that was implemented in two phases. The focus of both phases was to implement effective credit management controls that maintained a positive debtor-creditor relationship. This would lead to increased performance visibility and help keep their debt recovery bottom line controlled and managed.

Since implementing the solutions, maintaining a focus on debtor hardship mitigation controls and compliance, the client has seen the following results:

© Copyright 2025 Probe CX | All Rights Reserved

Privacy Policy | Responsible AI Policy | Financial Hardship Policy | Whistleblower Policy | Complaints Procedure | Supplier Code of Conduct